We’re delighted to publish our latest findings from our ‘UK Car Survey’.

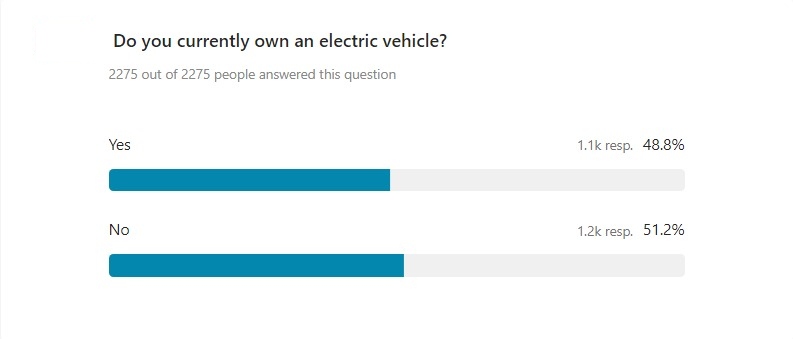

After receiving 2,275 surveys up to and including Tuesday 12th September, we thought it pertinent to showcase the next set of key insights.

Following a lot of unsubstantiated and clearly biased news articles over the last 6-12 months, Electric Road wanted to get a real snapshot of current opinions on the electric car & wider UK EV market from both existing & non-EV owners.

Like the initial findings, we thought it pertinent to publish key insights from non-EV owners & EV owners separately given the questions are different. We thought we’d start with non-EV owners first this time given the level of response we’ve had from them over the last month.

Response summary

The initial findings in August were based on a much lower response number overall (just over 650) and given our profile in the EV market, the survey was initially picked up by considerably more EV owners than non-EV owners. There were only 120 non-EV owner submissions when we published the initial set of findings. As of 12th September, we’ve received 1,165 surveys from non-EV owners, representing slightly more than half of all current respondents.

Non-EV Owners

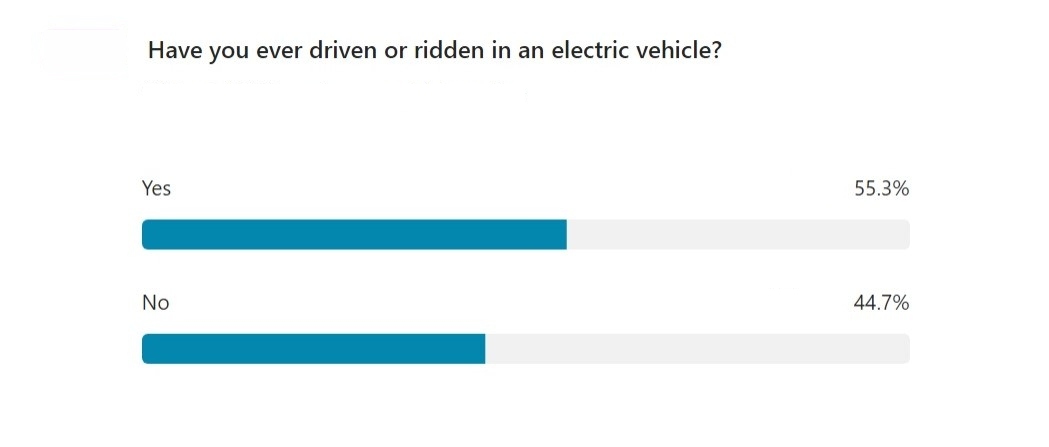

Exposure to EVs

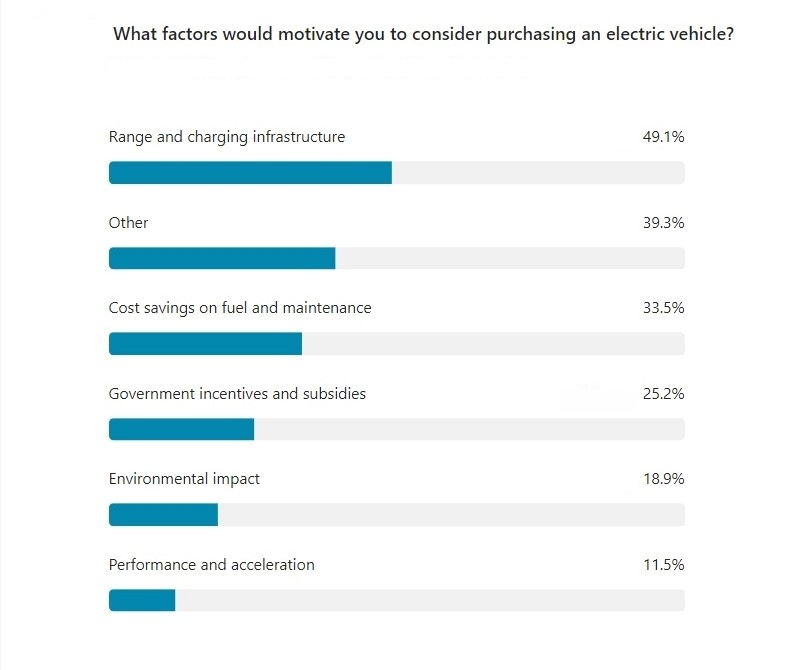

Motivating factors to purchase (multiple answers)

It’s self-evident that range & the current charging infrastructure are one of the prime motivators/barriers in getting people to buy an EV. It’s an obvious area to delve deeper into because one would presume the negative element here in that some/all non-EV owners think they require more range on a single charge and want the public charging infrastructure to improve ahead of buying their first electric car. Equally, we don’t know what degree (& source) of information and current experience they have of utilising an EV’s range capabilities & of public charging.

EAKBR

BREAK

BREAK

BREAK

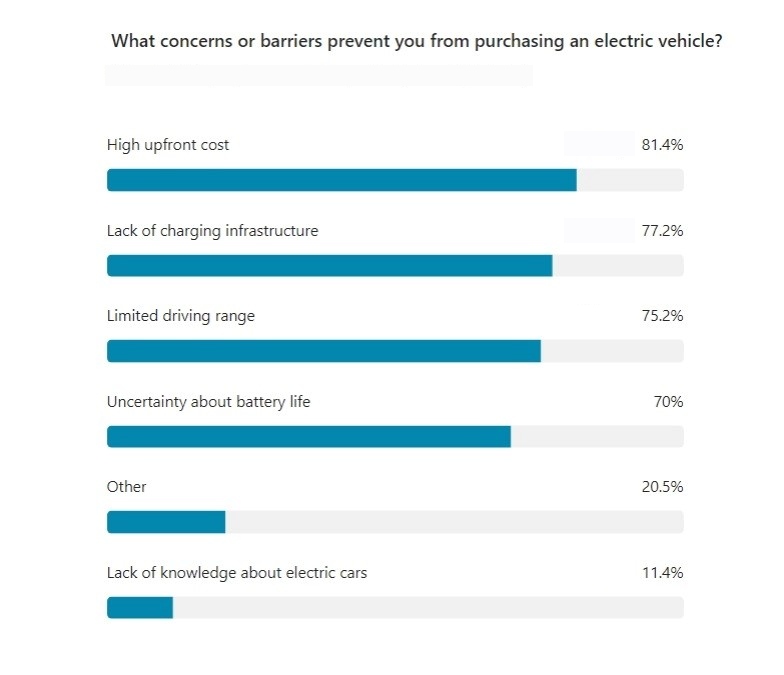

Concerns or barriers (multiple answers)

The high upfront cost of getting an EV is still the biggest barrier given a lack of more affordable new electric cars and a limited used car market. Once again, there were a significant number of responses for ‘Limited driving range’ and ‘Uncertainty about battery life’ which could well highlight a general misconception about what range people require on a daily basis and a lack of confidence/knowledge on a battery’s longevity.

BREAK

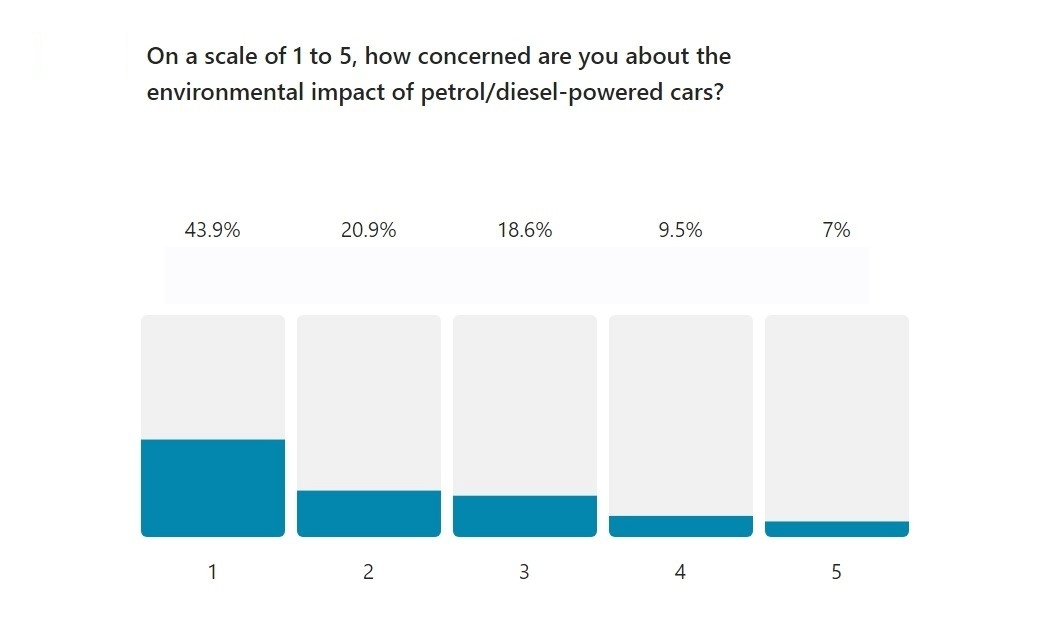

Environmental impact

With 5 being the most concerned about the environment and 1 being the least concerned, over 83% of respondents are indifferent or aren’t concerned about the environmental impact of ICE cars. This is up from 71% last month. As most of us know and understand, economic factors (alongside convenience & ICE cars being a more known technology) often trump other considerations, particularly environmental, sad as that is.

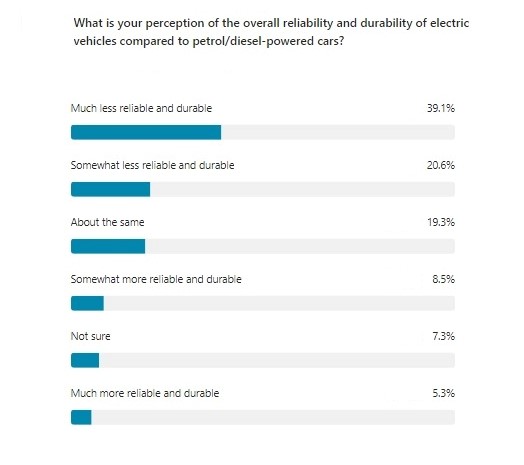

Perception of reliability & durability

There has been a huge shift from our initial findings on the perception of EV reliability & durability. Our initial findings in August showed 33% of non-EV owners believed EVs to be much more or more reliable & durable than ICE cars. In our September findings, this is down to just under 14%. Now, is the anti-EV press the driver behind this, particularly when you consider that 45% of non-EV owners have not ridden or driven in an EV yet? After all, this is about perception not actual experience.

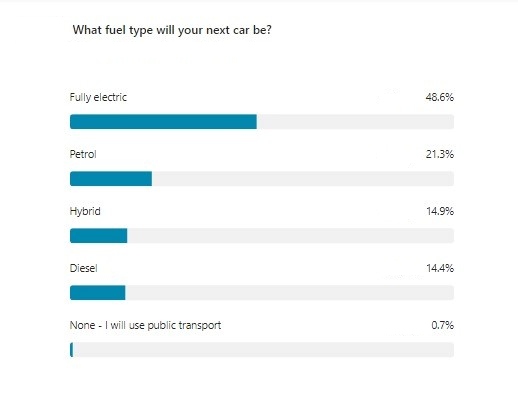

Fuel type for next car

It’s great to see that nearly half of all respondents will potentially go fully electric next time. However, this is down from the initial findings that showed 93% going electric for their next car. Clearly, the increase in non-EV owners will have shifted the figures somewhat.

We appreciate that EVs aren’t right for everyone, particularly right now and that there’ll be a mixed economy of fuel types on UK roads for many, many years to come. The saddest aspect for us of the fuel type responses is the lack of confidence people have in our public transport system.